About us

Australia's longest running Digital Asset investment fund, with a track record of market outperformance since inception

Magnet Capital was established in 2017 to provide a simple, transparent and reliable means for institutions and family offices to invest into the highly exciting - but complex - digital asset class.

Born on a foundation of lived expertise in the digital asset class, Magnet Capital is a crypto native investment manager. Magnet unearths differentiated investment opportunities through its deep integration with Web3 development communities and extensive on-chain data analysis.

Blockchain enabled digital assets are a natural evolution in the digital era as the world continues to transition rapidly to heightened digital compatibility. As they mature, digital assets will disrupt and reshape how some of the world’s largest industries operate. Magnet Capital strives to be at the intersection of this transition and provide investors with generational investment opportunities.

Magnet Capital views blockchain technology as one of the most globally impactful inventions since the creation of the internet. This groundbreaking innovation is creating unprecedented opportunities to disrupt and replace traditional business models.

There are innumerable factors enabling digital assets to experience exceptional growth and adoption, but none more so than;

Erosion of consumer trust

Software is eating finance

Digital assets are leveraging these tailwinds to overcome many of the shortcomings of traditional assets. This is largely being achieved through applying 6 core principles of blockchain technology;

Decentralised

Control and decision making resides in a distributed network rather than a centralised entity

Trustless

Based on open-source, transparent and auditable software, and without dependence on a central authority

Permissionless

No barriers to accessibility, anyone can innovate or participate

Immutable

Transactions are permanent, irreversible and unable to be altered, deleted or destroyed

Secure

Backed by a distributed, global network, without a single point of reliance or failure

Equitable

The same codified rules for all participants. No special access, no special terms

By employing these principles, blockchain technology enables the creation of decentralised protocols and applications that disintermediate inefficient or rent-seeking intermediaries and replace them with open-sourced code.

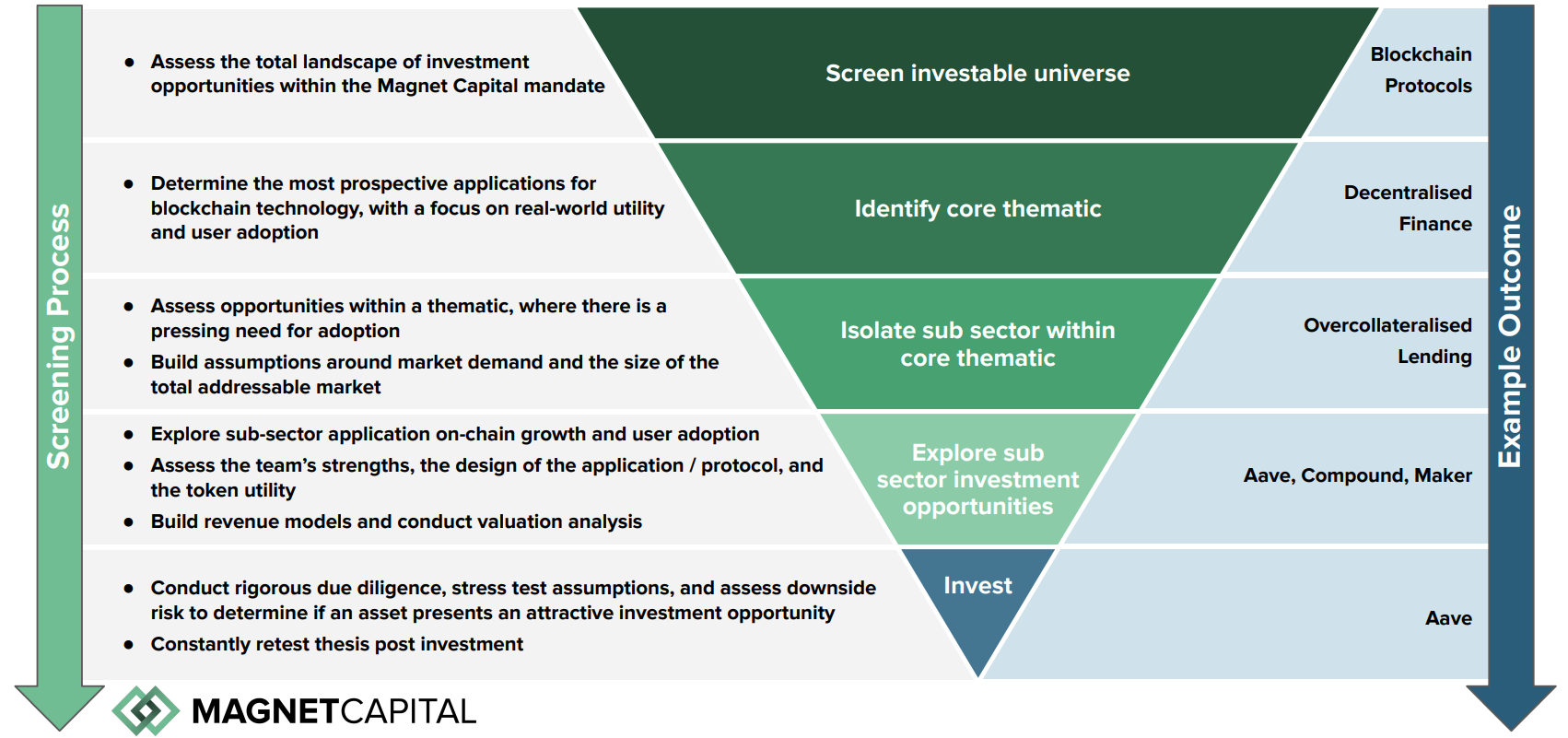

Magnet Capital employs a thesis driven, value based, long term investment strategy, that is focused on real-world application and utility above all. This approach aids in maintaining a high degree of conviction in an inherently volatile asset class.

To unearth alpha generating investment opportunities, Magnet Capital undertakes a structured, rigorous, investment approach centred around our four T’s methodology of digital asset investing.

Technology

A differentiated and disruptive product relative to its traditional competitors, with clear real world applications and utility

Tokenomics

Attractive return profile, scarcity of supply, and the capacity to generate substantial returns that accrue to holders

Timing

Assessing the market's readiness and demand for adoption, in order to understand the potential for utility generation

Team

A talented, driven, and experienced team with a strong focus on governance, and a track record of delivering.

For more information, get in touch with our team

Magnet has close integrations with institutional grade service providers

Accounting & Tax

Legal Services and Advice

Trust Registry Service

Wicklow Financial Services

AFSL Provider

Crypto Asset Custodian

Institutional Node Services

Sign up to our weekly newsletter

A snapshot of the market, key news headlines, project updates, fund raising events and insightful, data-driven metrics.