Passive Bitcoin Fund

The Magnet Foundation Trust (MFT) provides wholesale investors with simple, low-cost and secure investment exposure to Bitcoin (BTC).

MFT is structured as a traditional investment vehicle, an Australian Unit Trust. A unit trust structure allows investors to avoid the typical challenges associated with the buying, selling, safekeeping and tax reporting of BTC.

| Investment Objective | Units track the price of BTC, less fees |

|---|---|

| Inception Date | 2-Nov-2020 |

| Unit Issuance | Daily |

| Management Fee | 0.91% annually (excl. GST) |

| Minimum Investment | $250,000 |

| Performance Fee | 0% |

| Custodian | Coinbase |

| Additional Features | Monthly reporting and market commentary, manager support, annual tax reporting |

| Investor Qualifications | Wholesale Investors only |

| AFLS CAR | 001258408 |

Institutional Demand

Spot BTC ETFs have been the most successful financial products measured by AUM and flows. These flows validate the demand and positive perception of BTC in institutional circles.

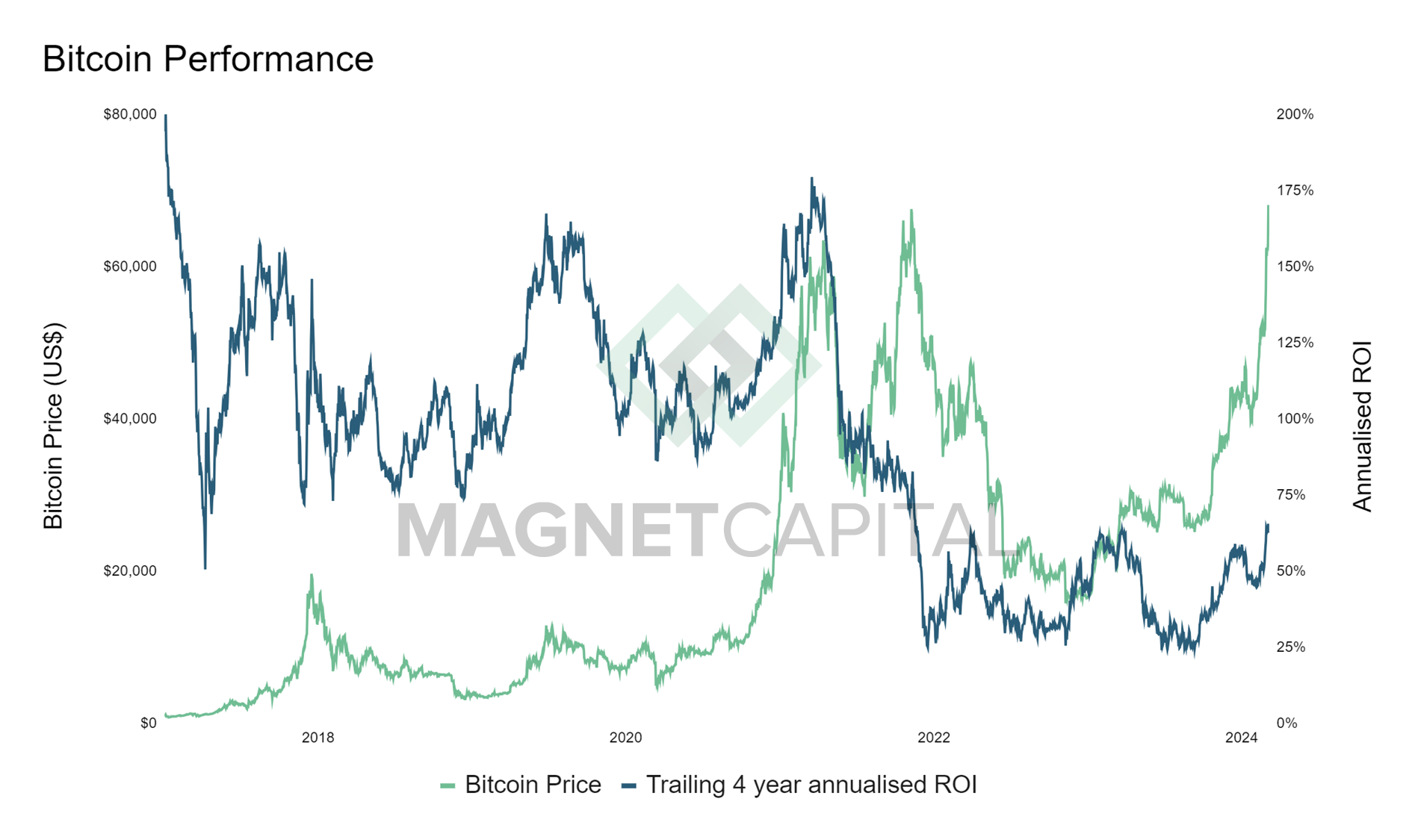

Programmatic Disinflation

Bitcoin's 4th halving (Apr-2024) structurally rebalanced the Supply vs Demand dynamics of BTC. This has historically resulted in positive price pressures.

Improving Regulatory Environment

The leading US Presidential candidate, Trump, is very pro crypto. Additionally, the historically harsh SEC continues to lose regulatory battles in US courts of law.

Finite Supply

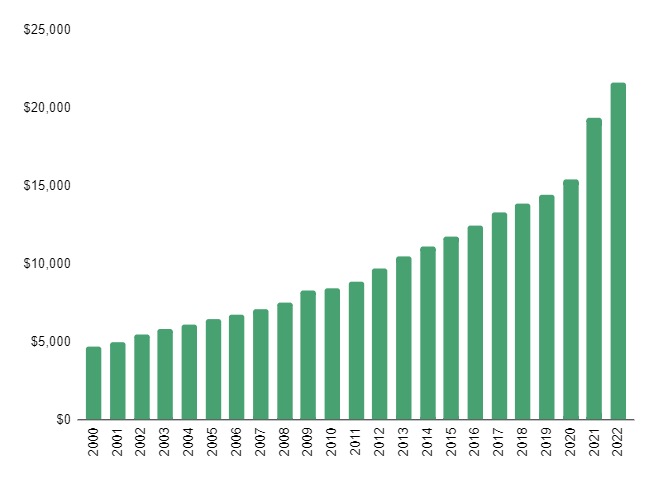

Bitcoin's limited supply of 21m prevents gradual debasement of purchasing power - a stark contrast to the exponentially increasing amount of fiat currency in circulation.

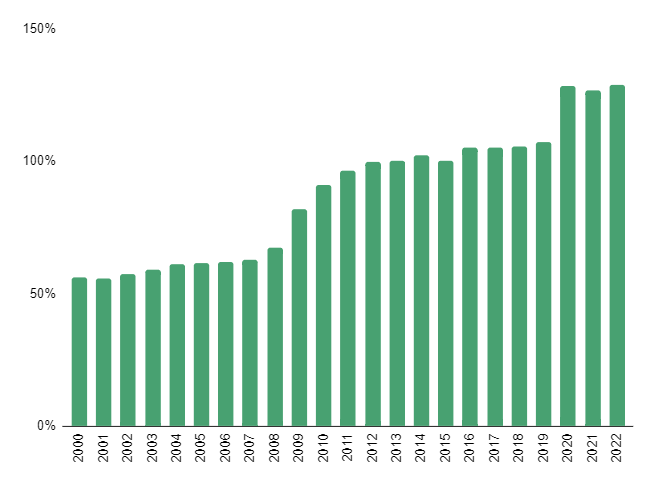

Hedge Against Fiat Economy

The fiat monetary system is in unchartered territory, with historically high levels base money (8.5x increase in the 21st century alone) and the average debt to GDP level of the G7 countries at 129%.

Hedge Against Centralised Banking Risks

Bitcoin was created in response to the centralised banking failures of the 2008/09 global financial crisis. Should banking sector issues arise again like they did in March '23 Bitcoin react positively again.

US Debt to GDP (%)

US M2 Money Supply (US$Bn)

Spot Pricing

Invest and redeem at the daily AUD.BTC spot price, with no discount to NAV

Licensed Manager

Magnet Capital is AFSL registered, and based in Sydney, Australia

Track Record

MFT launched November 2020. Magnet Capital has been operating since November 2017.

Liquidity

Magnet transacts in OTC markets with significantly higher volume than Australian exchanges

Introduction to Digital Assets

Introduction to Digital Assets, Cryptocurrency, NFTs, Bitcoin, Ethereum and DeFi for beginners

Insights

25 Jul 2022

Ethereum - Crypto's Infrastructure

Ethereum is the core infrastructure that drives the creation and operation of decentralised, blockchain-enabled applications

Ethereum

16 Jan 2023