Passive Ethereum Fund

The Magnet Voyager Trust (MVT) provides wholesale investors with simple, low-cost and secure investment exposure to ether (ETH).

MVT is structured as a traditional investment vehicle, an Australian Unit Trust.

This unit trust structure allows investors to avoid the typical challenges associated with the buying, selling, safekeeping, staking and tax reporting of ETH.

| Investment Objective | Units track the price of ETH, with upside potential from staking assets |

|---|---|

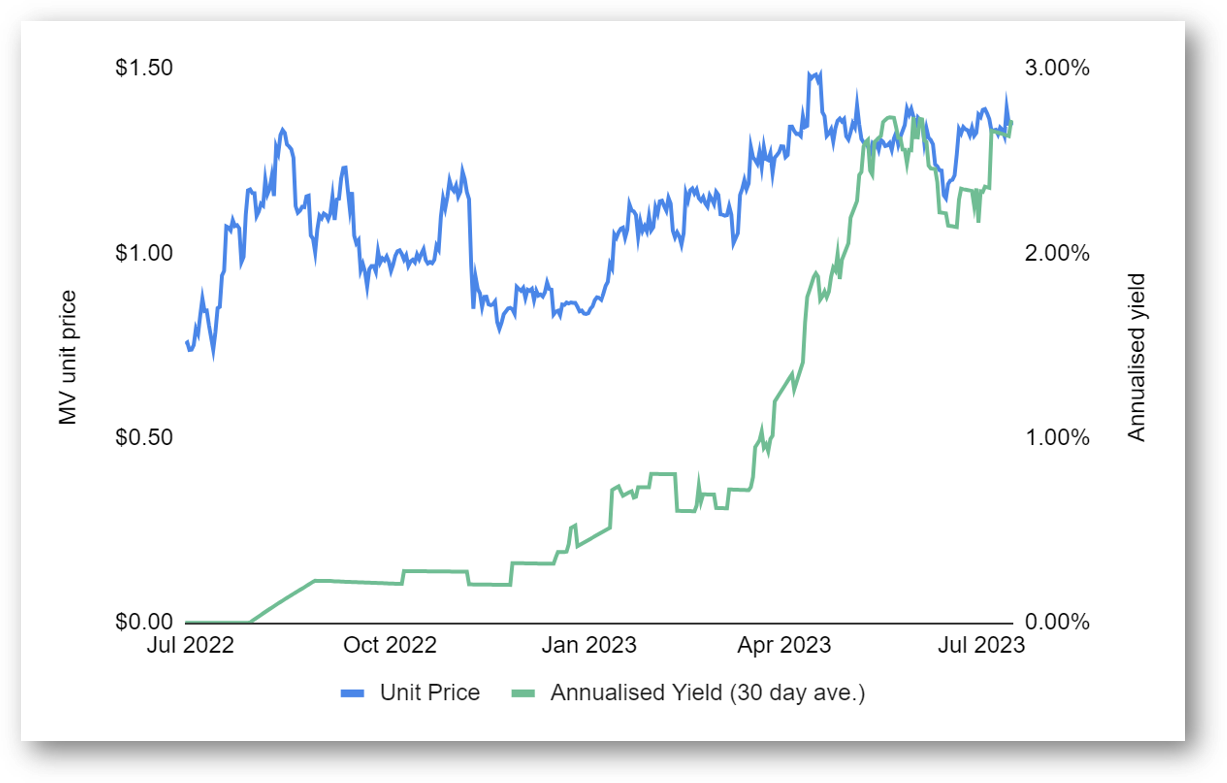

| Yield of staked ETH* | 3.7% |

| Inception Date | 25-Feb-2021 |

| Unit Issuance | Daily |

| Management Fee | 1.36% annually (excl. GST) |

| Minimum Investment | $100,000 |

| Performance Fee | 0% |

| Additional Features | Monthly reporting and market commentary, manager support, annual tax reporting |

| Investor Qualifications | Wholesale Investors only |

| AFLS CAR | 001258408 |

*Annualised, net of fees. Since Ethereum's Shanghai update on April 12th enabled staking withdrawals

Bitcoin’s core innovation of a decentralised, peer-to-peer, and open-source network was a groundbreaking technology. It enabled the creation of previously inconceivable digital store of value, that was able to be custodied and transferred without relying on a 3rd party.

Ethereum expanded on the core innovation of Bitcoin by creating a blockchain with a programmable, embedded computer. Where Bitcoin stores only transactional data on its blockchain, Ethereum is able to store and execute ‘smart contracts’.

Smart contracts are self-executing digitised agreements that automatically settle when an agreed condition is met. Smart contracts introduce significant efficiency gains by removing the need to interpret and enforce a contract, and trust your counterparty. As a result, they are used as the building blocks upon which decentralised applications and protocols are built.

Ethereum securely processes transfers and smart contract executions on its blockchain, and in return, users pay 'gas' fees in its native token ether (ETH). As a result, Ethereum is positioned as the core infrastructure upon which the decentralised economy is building upon.

Innovation, adoption and growth of the Ethereum ecosystem continue to take place at an exciting pace, and as a result an ETH investment provides simple and effective exposure to growth in the decentralised economy.

Programmable

Ethereum is designed to support complete customisability and complexity of transactions

Decentralised

A network of tools and products enabling users to transact and communicate without requiring a centralised authority

Proof of Stake (PoS)

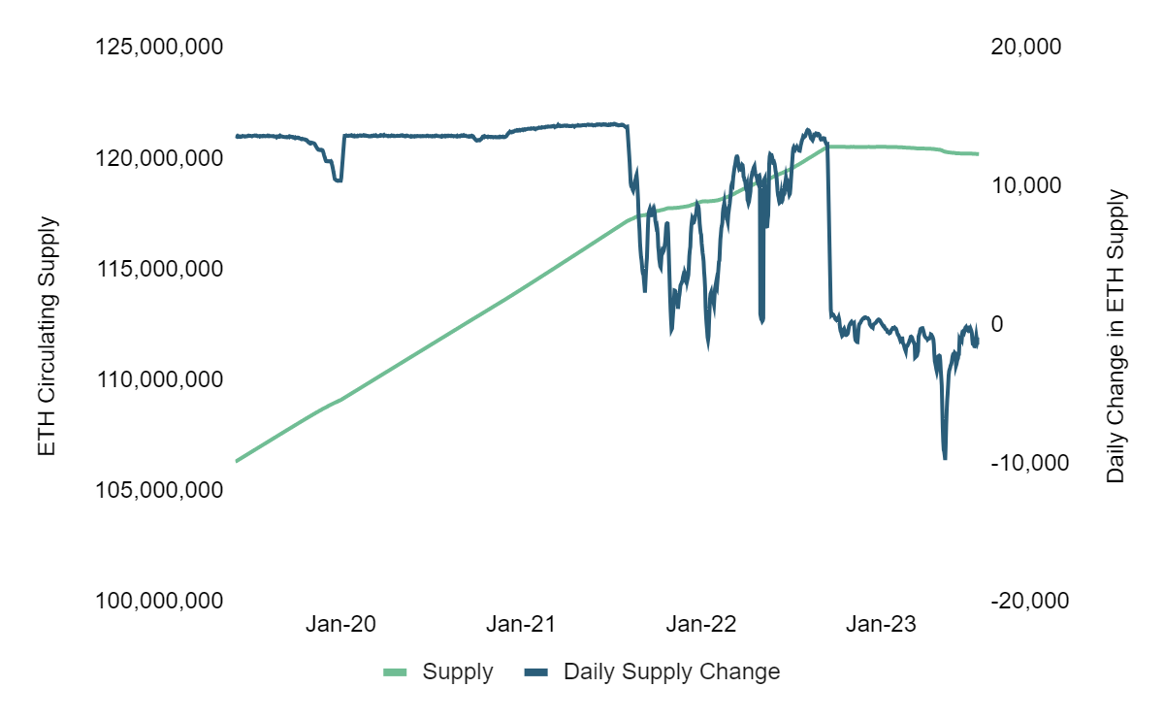

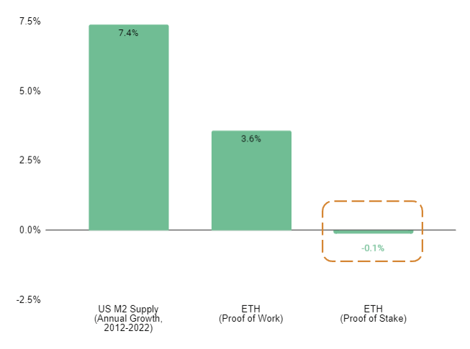

The Merge to PoS increased scalability and reduced the energy consumption required to secure Ethereum by 99.95%

Trustless

No barriers to entry and total transaction transparency

ETH Supply

Annual Inflation Comparison

Yielding

The MVT generates a yield for investors through providing validation services to Ethereum

Spot Pricing

Invest and redeem at the daily AUD.ETH spot price, with no discount to NAV

Liquidity

Magnet transacts in OTC markets with significantly higher volume than Australian exchanges

Licensed Manager

Magnet Capital is AFSL registered, and based in Sydney, Australia

Ethereum - Crypto's Infrastructure

Ethereum is the core infrastructure that drives the creation and operation of decentralised, blockchain-enabled applications

Ethereum

16 Jan 2023

Introduction to Digital Assets

Introduction to Digital Assets, Cryptocurrency, NFTs, Bitcoin, Ethereum and DeFi for beginners

Insights

25 Jul 2022

CeFi’s failures are DeFi’s opportunity

Recent failures of centralised financial service providers highlight the value and necessity of transparent, decentralised infrastructure

DeFi

1 Dec 2022